The Stock Market Crash of 2008

Rock Bottom

In September of 2008, the American economy was sent reeling. The New York Stock Exchange plummeted on numerous occasions. The stock market fell 345 points in one day on September 5th. By the end of the month, the stock market had lost 20% of its entire value.

Economically, the perception of what a business stands for is as important as what the actual business does.

Due to the prevalence of failing institutions such as Leeman Brothers and monopolies such as Wells Fargo swallowing up smaller corporations such as Wachovia, consumer's buying confidence was at an all-time low.

The insurance group AIG also suffered irreparable damage. The government bailed out AIG with an 85 billion dollar loan that was needed to pay its customers off who were insured through them and lost money due to bad mortgage loans.

The situation with Leeman Brothers was even worse; the government did not compensate any of their losses, despite the readiness of federal loan money. This is clearly an indication that unethical business practices had been going on for quite some time.

With the government seizing control of lending kings Freddie Mac and Fanny Mae, the golden rule of business had clearly been disobeyed. The bottom line in a market economy (like America's), is we should always try to keep supply in line with demand. That simply was not the case in 2008.

The economy in 2008 was completely broken. If the stock market had gotten the slightest bit weaker, even a billion dollar company like General Electric may have had to file for bankruptcy due to plummeting stock prices.

Because of this economic collapse, people were also forced to cut back on their spending.

The retail sector of the market is also a reflection of people's spending trends. After September 2008, retail sales plummeted and unemployment was at 6%. This was the highest unemployment rate had been in over five years.

However, the value of the dollar went up after the stock market crashed. At the time the market crashed, it was immediately suggested that people invest in gold because gold always maintains its value.

In the end, spending habits became cyclical. The price of commodities went down and people sold their stocks. The price of commodities went down because spending went down.

This is why the standard of living in America hit rock bottom shortly before Barack Obama became president.

Big Business Swallows up America in the 2000s

The focus of business is to produce a product at a lower cost than the competitor. If the business can be more efficient, they can put competition out of business. Efficiency lowers production costs, which allows the business to charge the same price as a competitor but make more profits.

With big businesses such as Walmart, if demand goes down, prices of the product should go down- but often big business is big enough (either a monopoly or shared monopoly) that they can keep prices from falling (or falling too much).

But if demand is going down, so are profits. So to protect profits, corporations reduce cost- especially the cost of labor, which in turn effects business efficiency. Therefore, this is why unemployment was higher than it needed to be.

In the 2000s, big business mergers reached unprecedented levels. Big business mergers try to eliminate competition so the company can control supply and set their own prices. The buying power of entities such as Wal Mart also put millions of companies out of business. In a healthy market economy, competition decides who is running most efficiently and forces innovation. Without competition, the basic market economy cannot work.

This is another major reason why the market fell so drastically in September 2008. Big business had eliminated competition.

In a market economy like America, competition is the regulatory system that controls prices. Competition in a market system also decides who is running most efficiently- not a monopoly. This entire half of a healthy market system had been all but eliminated in 2008.

Business failed in the late 2000s because of the monopoly business model. A motivating factor in the market economy is the idea that one uses their skills and talents in their own best interest- not the interest of the big business model.

The Four Steps to the Government Bailout of 2008

The first goal of the economic recovery plan established in October 2008 was for the government to buy troubled assets of financial institutions. Under this plan, 401K retirement plans invested in mutual funds were safe and not subject to fail.

The second goal of this recovery plan was to safeguard the assets of money market mutual funds. By eliminating bad debt in people's personal portfolios, over time this would eventually lead to good solid assets.

The third goal was to temporarily eliminate the short-selling of stocks. Short-selling is a method to make quick money by selling stock prematurely. The goal of owning any stock is to try to get price appreciation. So the emphasis was to buy stock and wait for the value to gradually rise.

The final aspect of the government's bailout in 2008 was the tentative agency that would permanently overlook the first three aims of this recovery plan. In addition to this, the agency would attempt to fix the crumbling real estate market.

The main idea was- if the government can successfully start loaning people money again, companies' production will go up, which in turn, will reduce unemployment.

This is why President Obama was so adamant about encouraging people to take out loans for school or other personal reasons.

At the time, spenders had become increasingly pessimistic about what to buy. People instead of betting that a stock will go up, were betting it would go down due to fear of losses and what was perpetuated through the media. The more people did this, the more companies feared the stock will go down, which lead to a turbulent stock market.

The primary goal of the Government bailout of 2008 was that the Government would end this speculation and finally put people's fears to rest. The secondary goal was to realign what a normal market economy consists of: price and competition.

US Federal Budget of 2007

Total Tax Revenue: 2.568 Trillion Dollars

| Types of Taxes

| Individual Totals

|

|---|---|---|

45%

| Personal Income Tax

| 1 Trillion 164 Billion

|

34%

| Social Security Tax

| 870 Billion

|

14%

| Corporate Income Tax

| 370 Billion

|

7%

| Excise Income Tax

| 164 Billion

|

TOTAL: 2.568 Trillion collected in tax dollars

|

Tax Expenditures of 2007

Percentage

| Expenditure

| Dollar Amount

| |

|---|---|---|---|

59%

| Health Care

| 1.611 Trillion Dollars

| |

20%

| Education

| 546 Billion Dollars

| |

13%

| Defense Spending

| 355 Billion Dollars

| |

8%

| Interest on National Debt

| 218 Billion Dollars

|

Poll

How did the stock market crash affect you?

Consumer Reaction to the Government Bailout

Since the government bailout of October 2008, the stock market has responded well. This wide sweeping reform allowed the government to buy bad mortgages on property people could no longer afford, restored financial institutions, loosened the stringency of who can get a loan, and stabilized the failing real estate market.

Consequently, the government's ability to control the money supply allowed for money redistribution through price support. For example, the government now has the ability to guarantee a set price on a good or service. If the market prices don't correlate to the government price, the government will tax citizens to compensate the set government price. This controversial policy has been used in the past with great success under president Ronald Regan.

A Global Approach to American Recovery

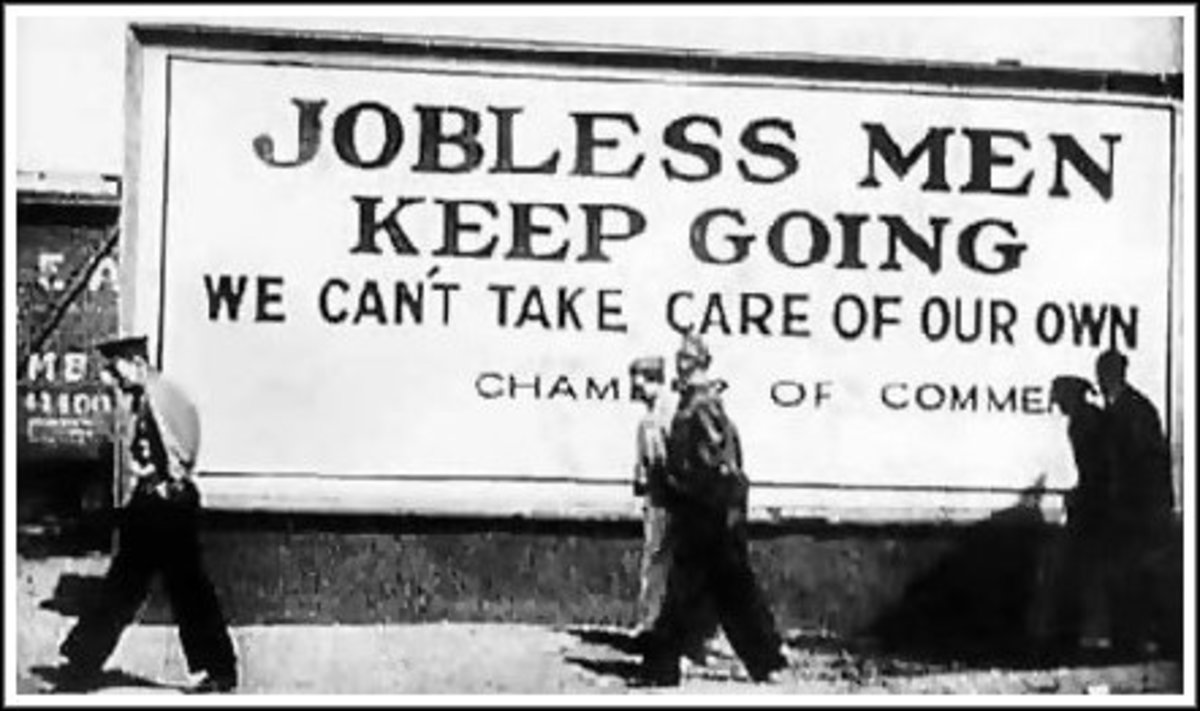

In 2008, the global and U.S. economy had not been this bad since the Great Depression. The government tried to curb panic through a global effort to let people borrow money and begin generating revenue.

The main purpose of the government intervening on private financial institutions was to strengthen and facilitate the day to day functionality of the market system. This is where President Obama's fiscal policies he inherited lead to controversy.

In order to stabilize the economy, another part of the ongoing recovery process was to redistribute income by taxing people with money and then transferring it to those who need it through entitlement programs.

At the time, this was the only viable option for America to maintain competition in the market and make the market function properly.

The Economy Today

The good news is that our country is slowly growing its economy back. Corporate profits are up which means that profit is going back to business owners and shareholders without the aid of the government.

However, our current president will be long gone before we can safely say that our economy has completely recovered. This type of long term recovery will take decades similar to what Ronald Regan did in the 1980s. He forced the economy into a deep recession by cutting government spending such as defense and raising taxes.

Although controversial at the time, by the end of the 20th century, our nation had a surplus- not a debt- when President Clinton left office.

One can only hope that the same results will transpire today.